Get the free construction estimate for bank loan format

Show details

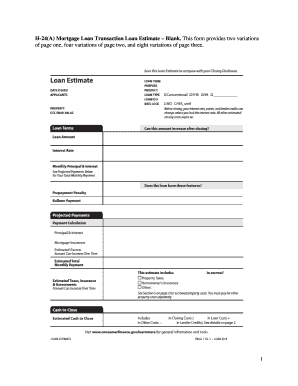

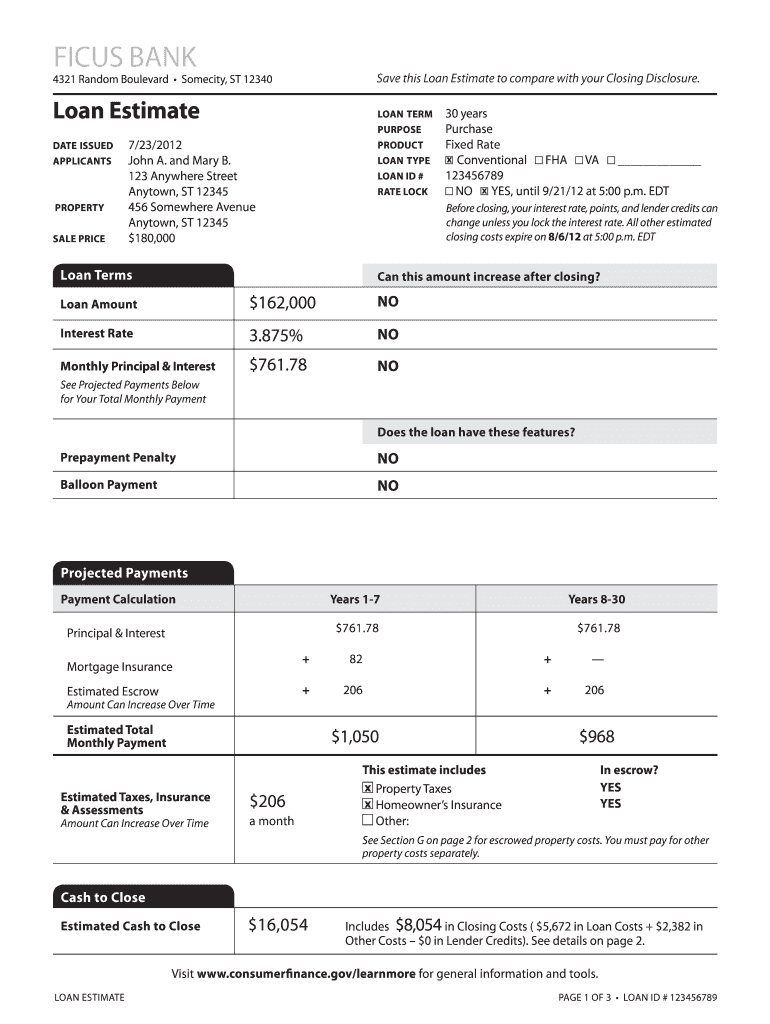

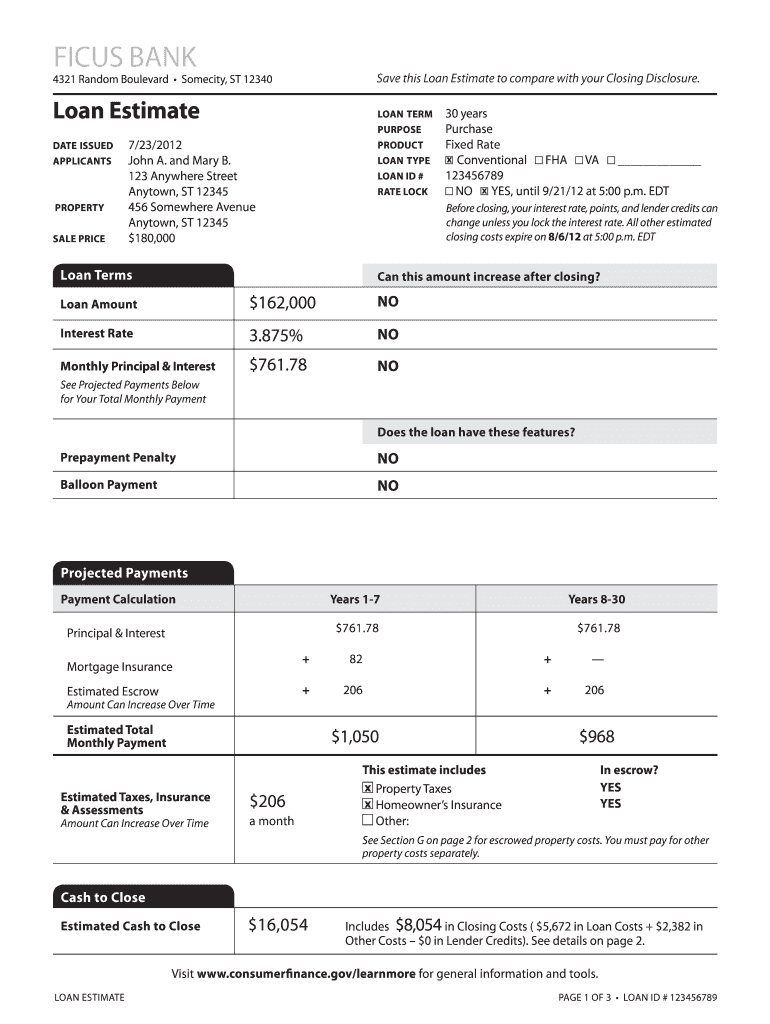

4321 Random Boulevard Some city, ST 12340 FICUS BANK Save this Loan Estimate to compare with your Closing Disclosure. LOAN Term Purpose Product LOAN Type LOAN ID # Rate LOCK Loan estimate Date Issued

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan estimate form

Edit your fill house estimate for bank loan pdf mobile with pdffiller instantly try now form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan estimate example form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit house estimate for bank loan pdf online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loan estimate example pdf form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how to fill out house 09 form

01

To fill out an estimate format for a bank, start by gathering all the necessary financial information and documentation. This may include income statements, balance sheets, tax returns, and any other relevant financial records.

02

Next, carefully review the estimate format provided by the bank. Familiarize yourself with the required fields and sections, and make sure you understand the purpose of each.

03

Begin by entering your personal or business information in the designated fields. This typically includes your name or company name, contact details, and any identification numbers or account references.

04

Proceed to input the specific financial data requested by the bank. This may involve categorizing your income sources, such as salaries, investments, or rental income, and reporting any additional sources of funds.

05

If applicable, provide details about any liabilities or outstanding debts that may impact your financial profile. This could include mortgages, loans, credit card balances, or other financial obligations.

06

Depending on the bank's requirements, you may need to include information about your assets, such as real estate holdings, vehicles, or investment portfolios. Be sure to accurately list each asset and its estimated value.

07

Double-check all the information you have entered to ensure accuracy and completeness. Review the estimate format thoroughly for any errors or missing data that could potentially affect the bank's evaluation.

08

Finally, submit the completed estimate format to the bank according to their instructions. This may involve submitting the form electronically through their online portal, mailing it to a specific address, or delivering it in person to a bank representative.

Who needs an estimate format for a bank?

01

Individuals or businesses seeking to apply for loans, mortgages, or other financial products from a bank.

02

Freelancers, contractors, or self-employed individuals who need to provide proof of income or financial stability.

03

Borrowers looking to refinance existing loans or negotiate better terms with a bank.

In summary, anyone who requires financial assistance or wants to establish a banking relationship may need to fill out an estimate format for a bank. It is essential to follow the bank's specific guidelines and provide accurate and comprehensive financial information to increase the chances of approval or a favorable outcome.

Fill

construction estimate format for bank loan

: Try Risk Free

What is loan estimate form?

A Loan Estimate is a three-page form that you receive after applying for a mortgage. The Loan Estimate tells you important details about the loan you have requested. The lender must provide you a Loan Estimate within three business days of receiving your application.

People Also Ask about house estimate for bank loan

What 4 things do lenders look at?

Lenders look at your income, employment history, savings and monthly debt payments, and other financial obligations to make sure you have the means to comfortably take on a mortgage.

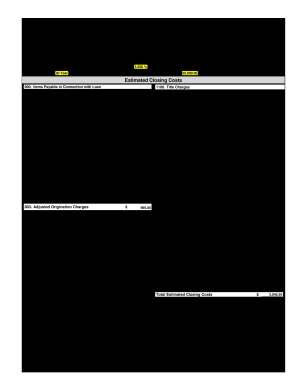

What is on page 3 of the loan estimate?

Key terms on Loan Estimate page 3: In 5 years — The total amount you'd pay toward the loan in five years, including principal, interest, mortgage insurance, and upfront costs. Annual percentage rate (APR) — Your combined interest and loan costs, represented as a percentage of the loan amount.

What are the 4 things used to help lenders determine the maximum amount that can be borrowed?

In determining an applicant's maximum loan amount, lenders consider debt-to-income ratio, credit score, credit history, and financial profile.

What is the loan estimate document?

A Loan Estimate tells you important details about a mortgage loan you have requested. Use this tool to review your Loan Estimate to make sure it reflects what you discussed with the lender. If something looks different from what you expected, ask why.

What is the fourth component of a loan?

The Four Components of an ARM Loan. ARM loans comprise four separate components: the index, the margin, the interest rate cap structure, and the initial rate period.

What information is included in the loan estimate form quizlet?

It includes the loan terms, the borrower's projected monthly payments, and final costs to get the mortgage and complete the transaction.

What four items appear on a loan estimate?

The Loan Estimate includes your estimated interest rate, monthly payment, closing costs and more. The Loan Estimate has only been around for a few years. In the past, you may have received two documents – the good faith estimate and the truth-in-lending statement – from your lender.

What forms make up the loan estimate?

The LE includes all the terms of the loan such as the interest rate and the projected monthly payment, including interest, principal, mortgage insurance and taxes. This new Loan Estimate form also shows all the fees required to process and approve the loan as well as estimated closing costs.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute building estimate format for bank loan in sri lanka online?

With pdfFiller, you may easily complete and sign bank loan sri lanka house estimate format sinhala online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I complete bank estimate format on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your home loan estimate format. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I complete construction estimate for bank loan on an Android device?

On an Android device, use the pdfFiller mobile app to finish your estimate format for bank loan pdf. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is construction estimate for bank?

A construction estimate for a bank is a detailed financial projection that outlines the expected costs associated with a construction project, including materials, labor, and other expenses.

Who is required to file construction estimate for bank?

Typically, contractors, builders, or project managers are required to file a construction estimate for a bank when seeking financing or loans for a construction project.

How to fill out construction estimate for bank?

To fill out a construction estimate for a bank, gather all relevant project details, calculate material and labor costs, and complete the estimate form by clearly listing all expenses, durations, and necessary contingencies.

What is the purpose of construction estimate for bank?

The purpose of a construction estimate for a bank is to provide a clear financial overview of the project's costs to assist in securing funding and to ensure that the project can be completed within budget.

What information must be reported on construction estimate for bank?

A construction estimate for a bank must report information such as project scope, itemized costs for materials and labor, timelines, contingency budgets, and any relevant project specifications.

Fill out your construction estimate for bank online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Estimate Sample is not the form you're looking for?Search for another form here.

Keywords relevant to building estimate for bank loan

Related to blank construction estimate form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.